Intel CEO Paul Otellini is retiring in May. Could a change in leadership ironically help the chipmaking giant keep up with mainstream computing?

Intel CEO Paul Otellini surprised the technology industry this week by announcing he would be retiring from the company in May 2013 after helping the company work through a leadership transition. Most industry watchers (and even the company’s chairman Andy Bryant) had expected Otellini to stay on at Intel for several more years. After all, leadership transitions at Intel are rare. The company has had only five CEOs in its 44-year history, and Otellini has been an Intel employee for 40 of those.

Otellini gave no specific reasons for his departure, save to note “it’s time to move on and transfer Intel’s helm to a new generation of leadership.”

Paul Otellini is generally credited with having kept the company’s nose to the grindstone on semiconductor design and manufacturing – and cornering about 80 percent of the PC market as a result. However, on Otellini’s watch, Intel has also been caught flatfooted by the mobile revolution. And where the PC market is stagnating, mobile is experiencing tremendous growth, mostly without “Intel inside.”

What does Otellini’s departure mean for Intel, and could new leadership bring a new direction to the company? Perhaps one that bring cheaper PCs and a new generation of mobile devices?

Otellini’s successes and shortcomings

Looking at Otellini’s tenure in Intel’s top chair, it’s important to consider Intel’s past. In the early 2000s, Intel found its market leadership challenged by AMD, which, in addition to bringing antitrust complaints, was able to undercut Intel on price just as demand for Intel’s most profitable chips dropped after the dot-com bust.

When Otellini came on board, he introduced the now-famous “tick-tock” model of annual processor updates: the “tocks” bringing advances in microarchitecture, while the “ticks” br0ught advances in manufacturing, essentially, making the “tick” processors smaller and more power-efficient. Otellini bet heavily on semiconductor design and manufacturing plants, and wound up bringing more than 20,000 new hires on board (although he was forced to lay off more than 10,000 other people shortly thereafter).

Otellini also expanded the company’s markets by putting Intel processors into places and products where PCs still had room to make inroads, including “digital home” offerings, enterprise, the health industry, and mobility. However, mobility largely meant notebook computers – not phones or tablets.

On the PC side, it paid off. Intel’s first “tock” were the original Core 2 processors in 2006, which brought a significant leap in processor performance and proved Intel could still develop technology that left competitors in the dust. The designs landed just as the industry was seriously converting to 64-bit architectures. The Core processors were also enough of an advance that they convinced Apple to drop IBM/Motorola PowerPC processors – a huge PR coup for Intel. The “tick” in 2007 shrunk those technologies down to 45nm.

The next “tock” in 2008 brought the first Core i3/i5/i7 processors, while the “tick” in early 2010 shrunk those down to 32nm. In 2011, Intel “tocked” again with Sandy Bridge (which had a $700 million hiccup), then “ticked” earlier this year with Ivy Bridge and a 22nm process. The next “tock,” dubbed Haswell, should land by mid-2013, and the “tick” in 2014 should be Broadwell, the first processor to use a 14nm process. Other chipmakers like AMD, Qualcomm, and Samsung aren’t demonstrating manufacturing and chip design expertise at Intel’s level. Simply put, Intel processor technology truly is leading the market.

These advances also kept investors happy by raking in money. On Otellini’s watch, Intel saw its global revenue jump from $39 billion a year to $54 billion. The company has also paid out some $23.5 billion to investors. Otellini also cleared clouds from the companies horizons by resolving antitrust cases with both AMD and the Federal Trade Commission (with no fines), although it’s still appealing a $1.34 billion antitrust fine from the European Union.

Intel’s biggest problem: fewer PCs, lots more mobile devices

Intel’s technology is solid, but two things happened during Otellini’s tenure that have put Intel on shaky ground: the global economic recession, and the revolution in smartphone and mobile technologies.

A worldwide economic downturn meant both consumers and businesses put buying new PCs on hold, hoping to cut costs by milking their existing systems for an additional year or two, meaning less demand for processors and less growth in the PC market.

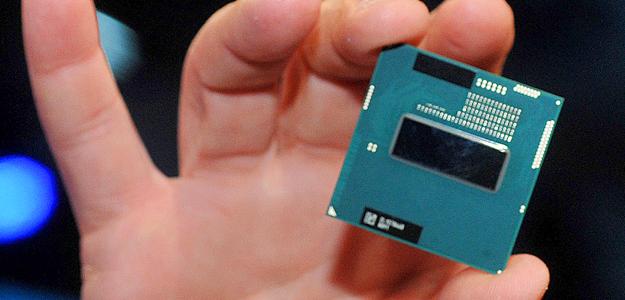

Consumers’ and enterprises’ embrace of smartphones and tablets – sometimes as replacements for traditional notebook computers – further crimped demand for PCs and Intel processors. Despite repeatedly trying to make low-power, low-cost processors for mobile devices (like its Atom line and even earlier efforts), Intel chips drive almost no mobile devices. Instead, most phones and tablets are powered by processors based on designs from the UK’s ARM Holdings, and are manufactured by the likes of Samsung and Qualcomm.

How bad is it? With a market cap of about $100 billion, Intel is the world’s biggest chipmaker in terms of revenue. On paper, however, it’s been eclipsed by Qualcomm, with a market cap of $106 billion, surpassing Intel largely due to the strength of its Snapdragon ARM-based processors.

Otellini’s approach to mobile seems to be that design advances from its flagship processors and the Wintel ecosystem will eventually trickle down and also power mobile devices, which is (loosely) the premise behind the Atom line. Despite some progress, such as a version of Android for Intel chips, Intel’s complex microarchitectures are originally designed for PCs. Making them power-efficient and backward-compatible is no small feat.

Intel also puts a premium price on its ability to run x86 software, which initially meant the sales proposition for Intel’s mobile processors amounted to we’re more expensive and use more power than our competition! In contrast, ARM processors are designed to be simple and power-efficient from the word go. While ARM processors aren’t compatible with the x86 world, they are more efficient and less expensive than Intel’s offerings. In fact, Apple is working on its own hand-optimized processor designs rather than relying on Intel, which makes the most advanced processor technology available.

This year, Intel claimed its Medfield line of single-core Atom processors were competitive enough with ARM systems to power smartphones. So far, there have been few takers, with Motorola’s Razr i being the best-known example. Intel’s next dual-core mobile processors, dubbed Clover Trail, are supposed to outshine ARM processors, serve as the heart of devices that can run x86 software, and offer all-day batter life and 30 days of standby time. Clover Trail was supposed to ship this quarter, powering a wide range of tablets and slates running Windows 8. However, Intel has yet to announce a launch date, meaning device makers hoping to ride Windows 8′s launch have now missed the wave.

Can Intel re-invent itself?

Even as the traditional PC market stalls and (eventually) shrinks thanks to widespread use of mobile devices, Otellini’s unexpected resignation could present an opportunity for Intel to reinvent itself and remain a ubiquitous force in mainstream computing. RBC Capital Markets analyst Doug Freedman wrote in a research note that “[a] shift in leadership could be welcome news to investors as Intel could be in greater position to broaden its portfolio into higher growth markets.” But how?

Show ‘em how it’s done – It used to be unthinkable that either pillar of the Wintel ecosystem, Microsoft or Intel, would try to tell hardware partners like HP, Dell, Acer, Lenovo, or Toshiba what to do. Microsoft broke that rule with its new Surface tablets, choosing to compete directly with its hardware partners to achieve a more Apple-like (or Xbox-like) vertical integration. Intel stepped close to that line with Ultrabooks, laying out basic specs that OEMs had to meet in order for the laptop to officially be called an Ultrabook. If Intel really wants to prove its mobile technology can compete with the likes of Samsung, Qualcomm, and Apple, Intel needs to make its own mobile devices. They could run Android; they could run Windows 8; they could run something entirely new. But if Intel truly wants to be a ubiquitous force in computing for the next couple of decades, it’s going to need a major presence in the mobile market. So far, OEMs aren’t stepping up, so it might be up to Intel to disrupt the mobile market all on its own.

Cut prices – Building multi-billion-dollar chip fabrication plants isn’t cheap, but, in the short-to-medium term, Intel can improve demand for its PC chips by cutting prices. One of the reasons Ultrabooks have so far failed to ignite the PC market is that they’re just too darn expensive – and a lot of that expense is Intel’s processors. Intel threw hundreds of millions of dollars at Ultrabook development but refused to drop or subsidize the cost of its processors, forcing manufacturers to ship pricey Ultrabooks or cut costs on everything but the processor (sometimes resulting in chintzy messes). Cheaper processors mean cheaper PCs, and that means more demand and volume for Intel chips. Plus, it’s a good way to continue to assert superiority over AMD.

Think outside the x86 box – Intel’s x86 architecture has been around for decades, and, ironically, so have the simpler ARM-based designs that are now powering mobile devices. The solution to Intel’s mobile problem is not licensing ARM processors. That’s antithetical to the company’s DNA. The heart of Intel is microprocessor design and manufacturing. Instead of focusing all efforts on extending the x86 ecosystem, Intel could apply some of its world-class brainpower towards the next revolution in microprocessors as well as the manufacturing technologies that will make them possible. Starting from a clean slate with no baggage, Intel is arguably the best-positioned company on the planet to develop the architecture that drives mainstream computing well into the second half of the 21st century. Are we really expecting x86 or ARM to get us there?

So who’s next?

Intel has had only five CEOs in its corporate history, and they’ve all been company veterans promoted from within. Intel plans to look at both internal and outside candidates to fill the CEO position, but current Intel execs most certainly have the inside track.

The leading internal candidates would seem to be Renee James (currently head of Intel’s software business), Brian Krzanich (COO and manufacturing head), and CFO/strategy chief Stacy Smith. Although Otellini came from the marketing side of the company, Intel has a tendency to favor engineering experience in the top seat. Krzanich may have a bit of a lead in that case, but Intel is not lacking in executive talent.

It’s not clear whether internal candidates steeped in Intel’s current business model will have the ambition and force of personality to divert Intel from the path it’s followed since the 1980s. Intel has known for over a decade that it needs to diversify its business, and it still isn’t there yet. Unless something fundamental changes with the Clover Trail mobile processor offerings – and there’s no indication of that happening – Intel needs to do more than keep on keeping on … and that argues in favor of a CEO from outside the company.

Source : digitaltrends[dot]com

No comments:

Post a Comment